Description

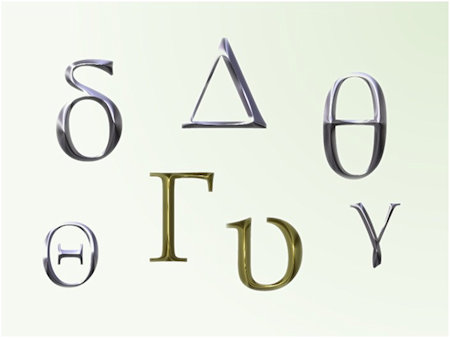

In this e-Learning course, we explore the fundamental principles of delta, gamma, vega, and theta (DGVT) risk sensitivities. We engage with you in practical exercises in Excel, to measure delta, gamma, and vega risk sensitivities and estimate portfolio profit or loss in response to market changes.

Who Should Enroll:

This course is ideal for finance professionals, traders, risk managers, and anyone seeking a deeper understanding of risk sensitivities in financial markets. It is suitable for College and University students who aspire to become risk and finance professionals.

What You Will Gain:

Upon completing this course, you will:

- Understand what risk sensitivities are and how they are used to estimate portfolio profit or loss.

- Apply the Taylor Series Expansion for risk measurement to arrive at delta, gamma, and vega.

- Measure delta, gamma, and vega risk sensitivities in Excel.

- Estimate portfolio profit or loss in response to market fluctuations, using risk sensitivities.

Course Duration:

1.5 hours

Course Access Duration:

270 days starting from enrollment date.