Description

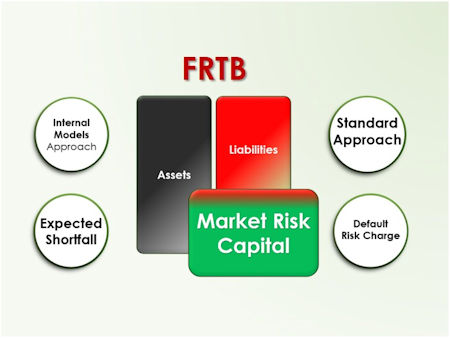

In this e-Learning course, we provide you with a deep understanding of the revised standards for minimum capital requirements in market risk. We explore the nuances of these requirements, the boundary between trading book and banking book, and the methods for calculating market risk capital charges under both the standardised and internal models approaches.

We engage with you in practical exercises in Excel, to calculate the market risk capital charge under Basel 4 (revised standards) and compare the results to Basel 2 and 2.5.

Who Should Enroll:

This course is ideal for risk managers, financial analysts, compliance professionals, and anyone seeking a deep understanding of market risk capital requirements and the implications of Basel 4. It is suitable for College and University students who aspire to become risk and finance professionals.

What You Will Gain:

Upon completing this course, you will:

- Acquire a practical understanding of the revised standards for minimum capital requirements in market risk, particularly under Basel 4.

- Clarify the boundary between the trading book and banking book and how positions are classified.

- Gain practical skills in calculating market risk capital charges under both the standardised and internal models approaches using Excel.

- Understand the impact of the revised standards on bank capital ratios and their broader financial implications.

Course Duration:

45 minutes

Course Access Duration:

270 days starting from enrollment date.