Description

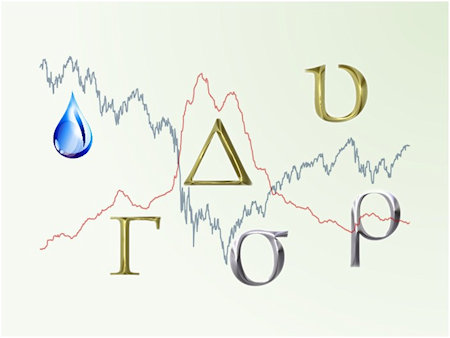

In this e-Learning course, we delve into the critical aspects of stress risk measurement. Learn to design stress scenarios based on risk factor volatility and correlation across various asset classes using Excel. Discover how to measure stress risk exposure for a portfolio containing simple investments and option positions across different asset classes.

Who Should Enroll:

This course is suitable for finance professionals, risk managers, quantitative analysts, and anyone looking to enhance their understanding of stress risk measurement and scenario design. It is suitable for College and University students who aspire to become risk and finance professionals.

What You Will Gain:

Upon completing this course, you will:

- Be proficient in designing stress scenarios based on risk factor volatility and correlation across asset classes using Excel.

- Master the measurement of stress risk exposure for diverse portfolios using delta, gamma, and vega (DGV) risk sensitivities in Excel.

- Understand how to adapt stress scenarios to account for fat tails, apply time-weighting, and address liquidity.

- Gain insights into the comparative use of DGV risk sensitivities and full revaluation for options in stress risk measurement.

Course Duration:

45 minutes

Course Access Duration:

270 days starting from enrollment date.