Description

This e-Learning course is designed to introduce you to the fundamental concepts of Value at Risk and provide a glimpse into portfolio risk analysis. Explore the core principles of VaR and its application in risk assessment. We engage with you in practical exercises in Excel, to calculate VaR for a portfolio consisting of three or more investments.

Who Should Enroll:

This course is course is ideal for individuals who want to grasp a core concept in risk management. Whether you are a student, a finance enthusiast, or a professional aiming to refresh your knowledge, this course offers a valuable introduction to the world of risk assessment.

What You Will Gain:

Upon completing this course, you will:

- Acquire a foundational understanding of Value at Risk (VaR) and its significance in assessing and managing financial risk.

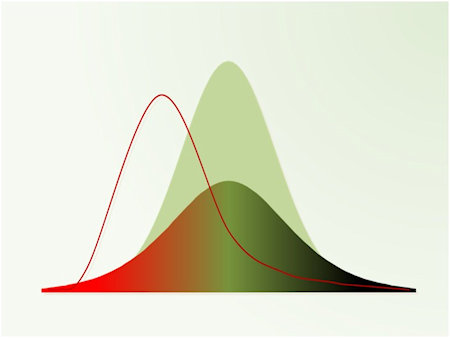

- Explore the two primary methods for calculating VaR (parametric and historical simulation) and understand when to use each method.

- Discover techniques to address the challenges posed by fat-tailed volatility and the importance of time-weighting in VaR measurement.

- Gain practical experience by measuring VaR for a portfolio of three or more investments using Excel and relevant risk metrics.

Course Duration:

1.5 hours

Course Access Duration:

270 days starting from enrollment date.